The Alberta Government has proposed legislation that gives municipalities a tool to collect overdue taxes from oil and gas companies.

On Thursday, October 28, the government introduced Bill 77, an amendment to the Municipal Government Act. If passed, it will restore a special lien municipalities can use to require oil and gas companies to pay overdue property taxes.

“This legislation is intended to help municipalities go after those companies who refuse to play by the rules. Bad actors who ignore the rules and don’t pay their taxes force everyone else to fill in the gaps – that’s not fair,” said Ric McIver, Minister of Municipal Affairs.

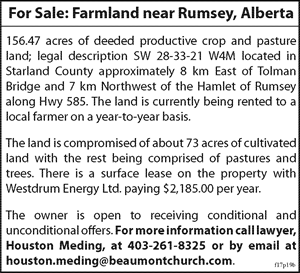

This has been a long-standing issue for Starland County. They took a huge hit when Trident Exploration ceased operations in 2019, leaving a multimillion-dollar hole in the county’s finances. Other companies have also refused to pay taxes.

If Bill 77 is passed, it means if a company becomes bankrupt or decides not to pay their property taxes, municipalities will have a tool to convince them to pay, or else property may be seized to cover outstanding debts.

The Bill reads “…taxes due to a municipality on linear property or on machinery and equipment (a) take priority over the claims of every person except the Crown, and (b) are a special lien on all the debtor’s assessable property located within the municipality, including any assessable improvements to that property.”

Starland County Reeve Steve Wannstrom is happy to see action being taken. He does note the majority of the resource companies are responsible and pay their taxes.

“I think it will make those guys that were pulling that card saying ‘we just won’t pay.’ That might stop them from doing that,” said Wannstrom. “On the other hand, I wonder what are we going to seize? If they are a smaller company, we don’t get the land. Do we get the assets potentially? It could be contaminated. Are we just taking on liability? There are just so many unanswered questions, so we’re not 100 per cent sure what we think of it.”

“I am glad they are stepping up and making an effort. I hope it is enough, and I hope it is the push some of them need that aren’t paying.”

In March of 2021, the Mail reported, at that time, rural municipalities were owed nearly $250 million. At the time, Starland’s amount was over $10 million.

The government also announced it would extend the Provincial Educations Requisition Credit. (PERC). The PERC allows municipalities to offset uncollectable education property taxes on delinquent oil and gas properties with an equivalent tax credit. The PERC program will be extended to the 2023-24 fiscal year to give municipalities time to use the special lien, if necessary, to seek the taxes they are owed.