Cenovus operations in the area may soon be sold for cash proceeds of $1.3 Billion.

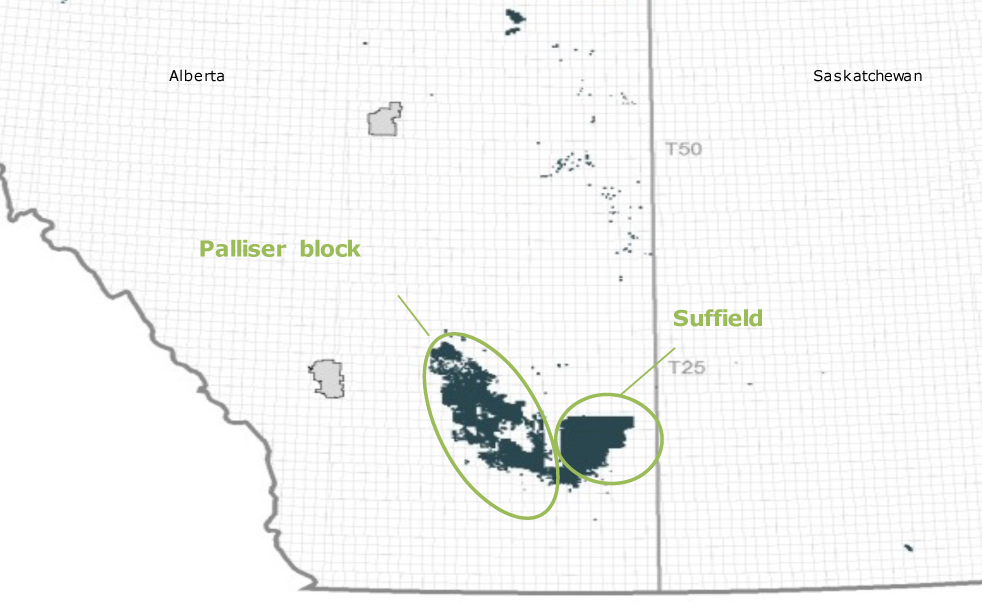

The company announced on October 19 that it has reached an agreement to sell its crude oil and natural gas assets in the Palliser Block to Torxen Energy and Schlumberger. According to a press release from Cenovus, the proceeds from the sale will be used to deleverage the company’s balance sheet.

“Our strategy to optimize our portfolio by selling non-core assets and using the proceeds to pay down debt is firmly on track,” said Brian Ferguson, President & Chief Executive Officer. “We continue to target between $4 billion and $5 billion in announced asset sale agreements by the end of the year, and we remain committed to returning to our long-term debt ratio target.”

The Mail reported in December of last year that Cenovus was planning to invest $160 million of growth capital and had identified about 700 attractive drilling opportunities.

The Palliser Block surrounds Brooks at the southern end and extends towards Drumheller at its northernmost point. It has a current production of 54,000 Barrels of oil equivalent per day.

This deal comes about a month after the company announced an agreement to sell its crude and natural gas operations in the Suffield block to International Petroleum Corporation for $512 Million.

Both deals are expected to close in the fourth quarter of this year, subject to customary conditions.

“We continue to expect that the Palliser sale will close before the end of the year,” said Brett Harris, manager external communications, for Cenovus. “Once the transaction has closed the operations will transfer to the new owners.”